20+ Conventional 97 loan

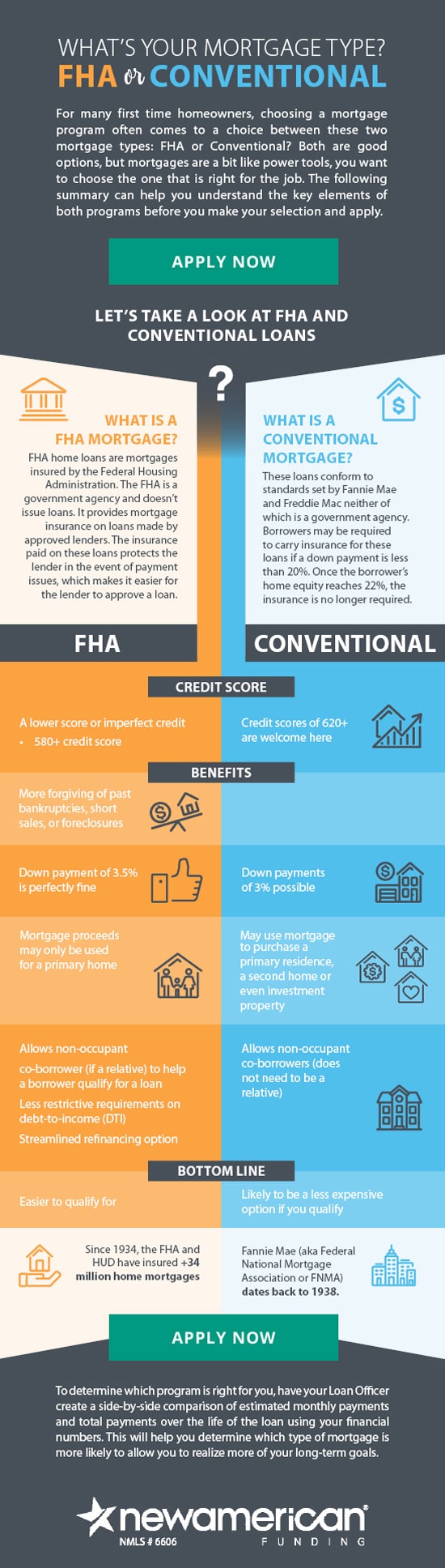

There are also tradeoffs in choosing a government-backed versus a. Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance until the loan balance falls below 80 of the homes valueThis insurance is rolled into the cost of the monthly home loan.

Cmp Lending Guide 17 01 By Key Media Issuu

APR based on 165000 Conventional loan assuming the highest credit rating.

. 20-Year Fixed Rate. - Up to 97 LTV - Income at or below 80 of the area median income AMI. This monthly payment protects the bank against the risk of loan non-payment.

Home equity combined loan-to-value ratio. The right type of loan is out there. This loan program allows borrowers to choose any loan term from eight to 29 years.

CalHFA has loan programs such the first mortgage conventional or CalPLUS fixed. It is only required on a typical conforming mortgage if you pay less than 20 down until you have at least 22 equity in the home or 20 equity and you request the fee removed. Your actual rate may vary depending on your specific terms.

And conventional loans offer lower mortgage rates the higher your credit score is. Though Fannie Mae and Freddie Mac have designated high-cost areas where limits are higher. With HomeReady you can get 10- 15- 20- or 30-year fixed rate mortgages and you can also get 5- 7- and 10-year adjustable rate mortgages.

Unlike a low-downpayment FHA mortgage Conventional 97s use traditional PMI policies. 46000LB Full Locking Rears. Homebuyers who get a conventional loan and put down less than 20 percent of the homes purchase price are usually required to pay PMI.

USD 000 Financial Calculator. Certain property types are ineligible. 20000LB Steerable Air Lift Axle.

Details Details Video Video. Only 139000 Original Miles. If a conventional loan isnt a great fit thats okay.

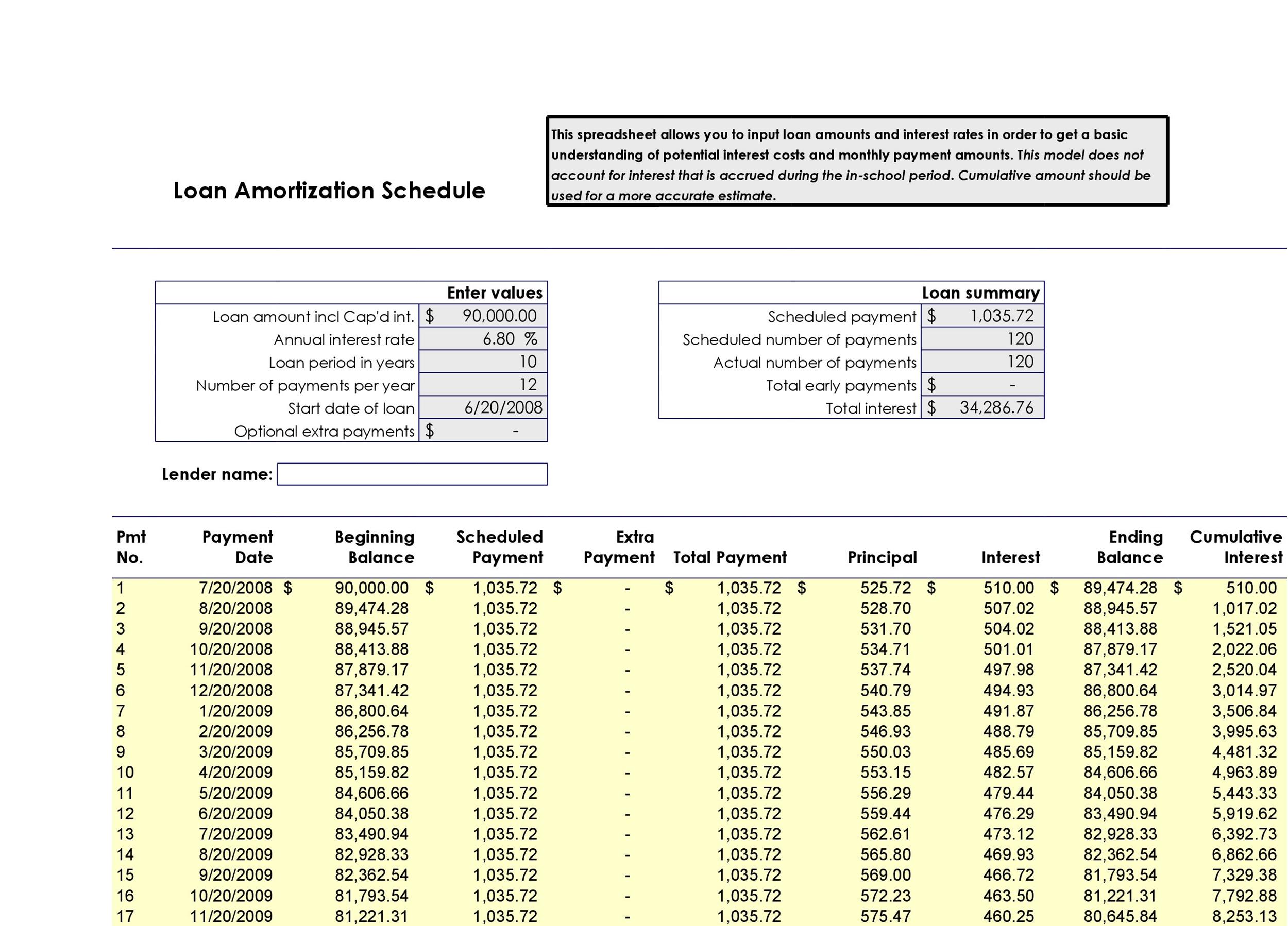

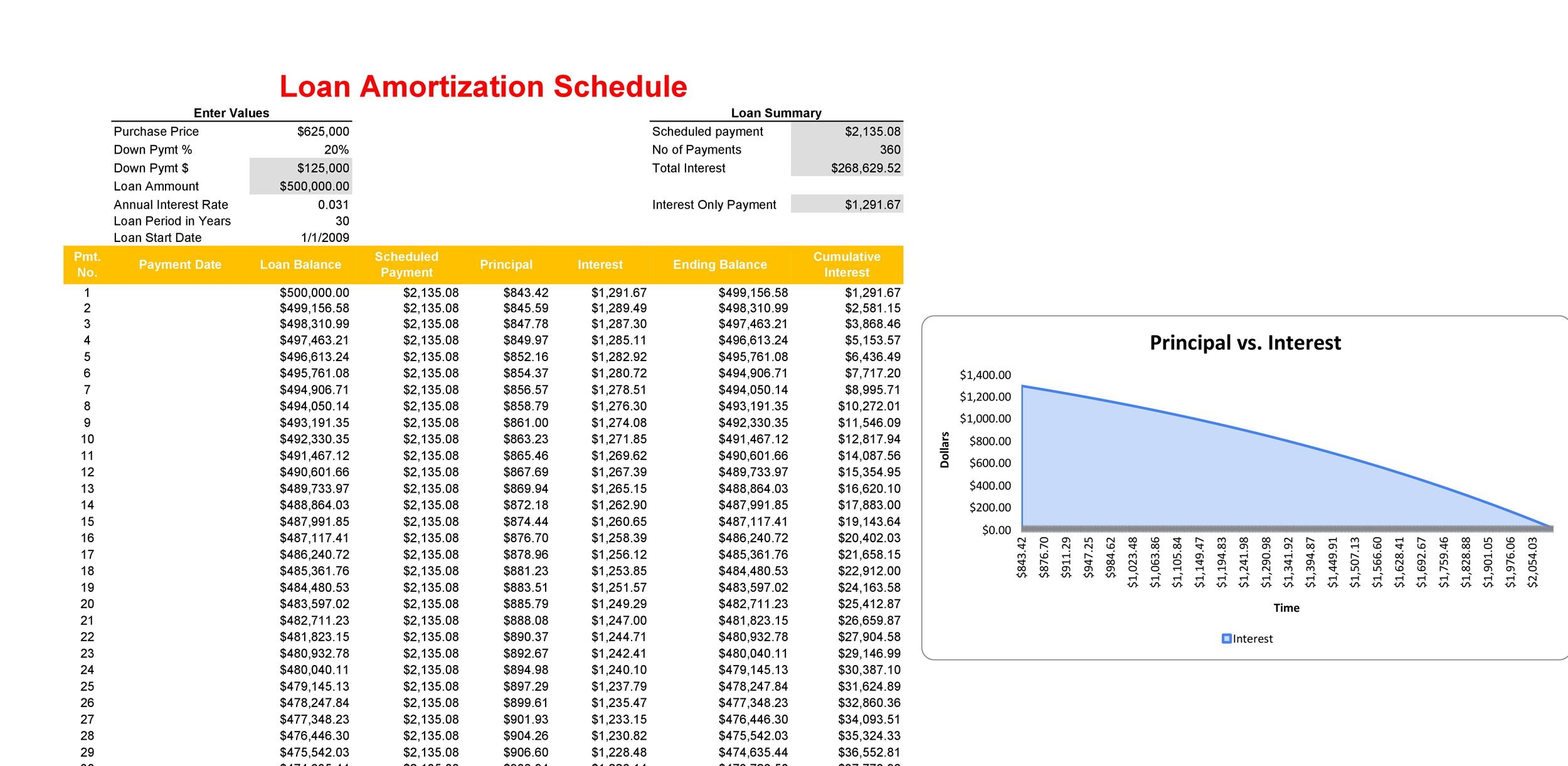

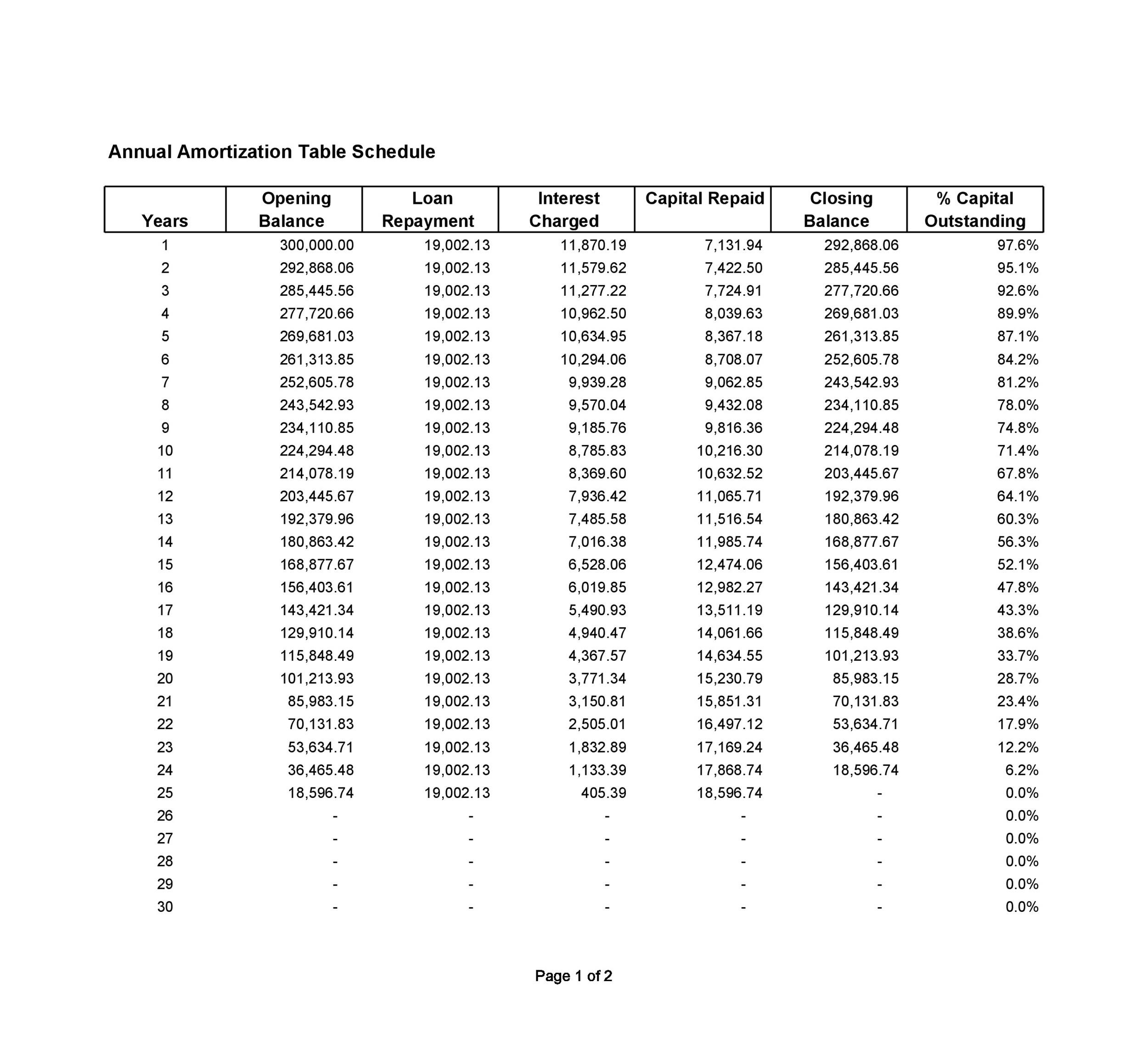

If you dont pay the delinquent balance in those 20 days the lender or mortgage. Requirements for conventional first mortgage loans eligible for delivery to Fannie Mae. Generates an amortization schedule for an Interest only mortgage loan that later is converted to a conventional fixed rate mortgage.

Conventional loan guidelines 2022 2022 conventional loan limits. Because you may be paying loan discount points and other prepaid finance charges at closing the APR disclosed is often higher than the interest rate on your loan. This loan does require mortgage insurance but itll be cheaper than mortgage insurance on the Conventional.

Use SmartAssets free California mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. And the balance is then amortized out to a standard conventional fixed rate loan for the remainder of the loan term. 0 to 112th APR.

This monthly fee which protects the mortgage lender in case of default is required on all conventional loans with less than 20 down. Ask your lender if the loan you are considering requires private mortgage insurance or a mortgage insurance premium MIP. The conventional loan limit for 2022 is 647200 for a single-family home.

Quickens 8-year terms option was the lowest fixed-rate term weve found from lenders online. Conventional 97 loan. Use SmartAssets free Texas mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more.

When you compare that to a 30-year fixed loan at 35 percent the cost would be about 900 per month. These can be canceled at a future time after the loan passes an 80 loan-to-value LTV ratio. 1 Unit 9701 2 Units 8501 3-4 Units 7501.

Conventional Day Cab Trucks. The conforming mortgage loan limits for 1-4 family homes are respectively 647200 828700 1001650 and 1244850. The conventional 97 loan also lets you put just 3 percent down while FHA requires 35 percent at minimum.

Maximum loan-to-value LTV is 97. Qualifying for these loans is a bit different than with conventional loans. Home buyers who have a strong down payment are typically offered lower interest rates.

- Loan amounts up to 647200 - A conventional loan can be used to finance a property in a high-cost area - 15- 20- 25- 30-year fixed rate - Down payments as low as 3 depending on loan amount. If your credit is good but your ability to save up a downpayment is limited a Conventional 97 loan might be a good choice for you.

Incredible 2 Months From 2nd Of December Conventional Loan Mortgage Loans Mortgage Refinance Calculator

Bailey Pawlowski Mortgage Professional Mr Cooper Linkedin

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

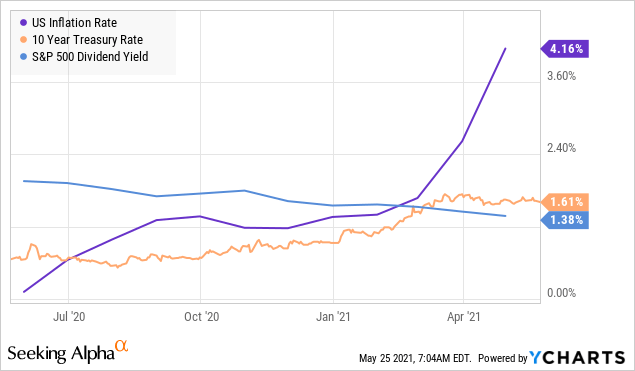

Inflation Running Hot 3 Big Dividends To Beat It Oxlc Arcc Nymtm Seeking Alpha

/GettyImages-105928203-59f3d2b3519de200116cf1a1.jpg)

Understanding What Fannie Mae Does

97 Real Estate Infographics How To Make Your Own Go Viral Real Estate Infographic Home Mortgage Home Loans

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Conventional Mortgage Outlet 52 Off Www Ingeniovirtual Com

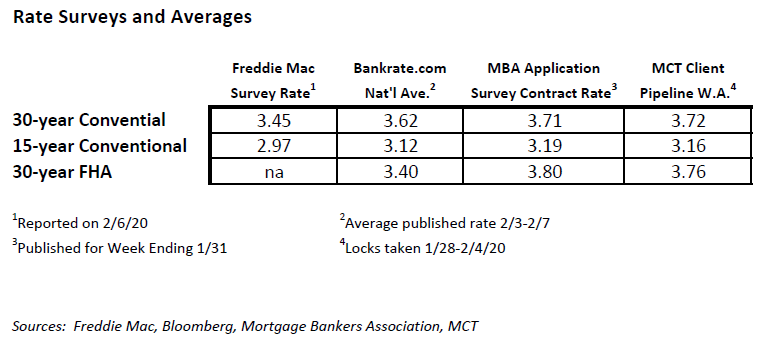

Mbs Weekly Market Commentary Week Ending 02 07 20 Mortgage Capital Trading Mct

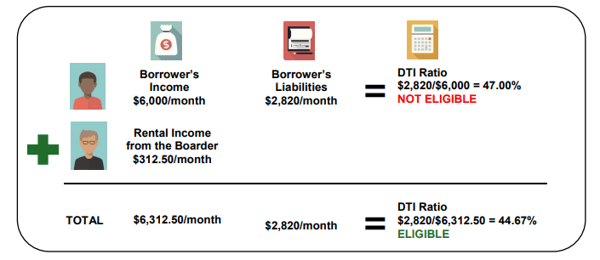

What Is Boarder Income And Can I Use It To Qualify For A Mortgage

Funding Sources Average Ranks All Business Models Download Scientific Diagram

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Types Of Mortgage Refinancing Programs Refinance Mortgage Refinancing Mortgage Refinance Loans

Conventional Mortgage Outlet 52 Off Www Ingeniovirtual Com

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Cct Luminous Efficacy And Luminous Efficacy Increase Compared To The Download Scientific Diagram

What Should I Do If A Stock In My Portfolio Is Down By 45 Quora