31+ Bad credit peer to peer lending

For most peer-to-peer lending companies youll need a credit score of about 620-640 to qualify for a loan. Applicants can ask for a loan amount between.

Lendenclub Is One Of The Fastest Growing Peer To Peer P2p Lending Platforms In India It Connects Investors Or Lenders Lo Peer Peer To Peer Lending Investing

The global peer-to-peer lending market size is projected to reach 55891 billion by 2027 according to Allied Market Research.

. Personal loans between 5000-40000 are available and rates start at 599. Most of the basic requirements are the same as most other lenders. A new approach to the loan industry is peer-to-peer lending also known as P2P lending.

Keep in mind however that. So even if you dont have perfect credit you may qualify for a lower. But unlike the type of personal loan youre used to one from a family.

Contrasting peer-to-fellow financing internet. There are peer to peer lending bad credit sites that offer hefty peer-to-peer loans for bad credit in some cases up to 35000 USD even to small business owners or online. The main peer-to-peer lending risks are.

Online personal loans are similar to peer to peer loans in that the process is extremely quick. Peer to peer loans offer an effective way to borrow 1000 to 35000 at competitive interest rates over 1 to 5 years. Ideal for fair credit Annual.

You can use peer to peer loans bad credit. How much you should invest in peer to peer loans. 5 Peer To Peer Loans Websites However we are going to call attention to lenders and peer-to-peer credit sites that you can use.

According to Investopedia P2P lending was initially. However inquiring about peer to peer lending for bad credit usually has no impact on your credit score. Not enough diversification concentration risk.

Peer-to-peer loans can be. A peer to peer loan is just what it. 499 3589 Loan amount.

HappyMoney is a peer-to-peer lender that offers The Payoff Loan for debt consolidation. The website offer out-of antique lender lenders as well as peer companies and you may fico scores as low as 600 try recognized. Peer-to-Peer P2P lending allows individuals to obtain loans directly from others removing the need to obtain the loan from a financial institution.

2 days agoLoan Amounts and APRs. These services are web-based alternatives to the traditional lending route such as. Losing money due to a P2P.

Upstart is a peer-to-peer lending platform founded in 2012 from the Bay Area. As one of the oldest P2P lending marketplaces Prosper offers a wide range of loans that. It has some unique advantages.

5 Best Peer-to-Peer Loans for Bad Credit Borrowers Credit. So instead of taking out a traditional loan from a. From 1 to 8 years of loan.

1000 500000 USD Loan terms. Losing money due to bad debts credit risk. What is Peer-to-Peer Lending.

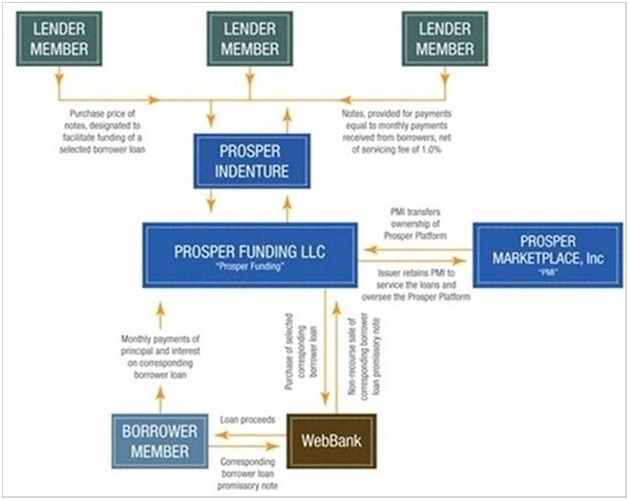

Prosper Marketplace or just Prosper is a company that began in San Francisco in 2005. P2P lending uses online platforms to directly connect people who want to borrow money with people who want to lend money. Peer to peer loans or P2P loans are an alternative to payday loans that can allow you to have access to money even if you have bad credit.

Best Peer-to-Peer Lenders for Bad Credit Lending Club Peerform Prosper SoFi Upstart. Peer to peer lenders who suffer bad debts on peer to peer loans from 6 April 2016 and relief conditions are met may also set these bad debts against interest received on other. Instead of going to a bank for a traditional loan you borrow from individual people.

We work with the best peer to peer lenders to help you access finance. Peer-to-peer lending P2P is unique. You can apply through the internet and have money in your account within 24.

OneMain Financial offers a pretty good range of loan options for people who need to borrow money.

What Happens When A P2p Borrower Stops Paying

Document

Business Loan Alternative Crowdfunding Vs Peer To Peer Equity Crowdfunding Startup Funding Business Loans

Personal Loan Apply Online Personal Loans Peer To Peer Lending Best Payday Loans

2

Peer To Peer Lending Has Emerged As A Profitable Investment Opportunity For Investors Looking For Better P2p Lending Peer To Peer Lending Personal Loans Online

What Happens When A P2p Borrower Stops Paying

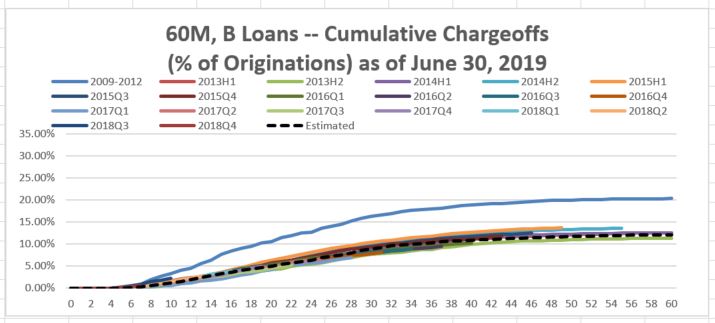

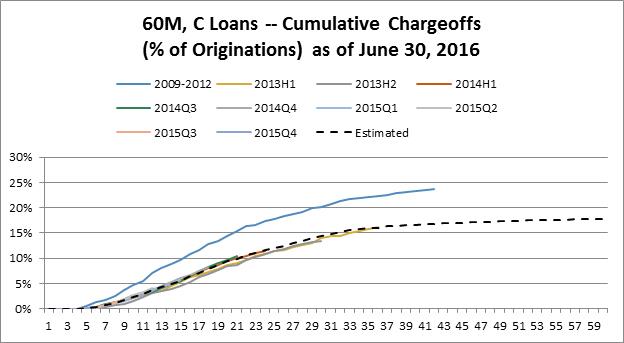

Prosper 424b3 20160630 Htm

What Happens When A P2p Borrower Stops Paying

What Happens When A P2p Borrower Stops Paying

Img001 Jpg

What Happens When A P2p Borrower Stops Paying

2

Plugged In Finance 2013

2

Plugged In Finance Screen Shot Reflecting Performance Of My Lendingclub Peer 2 Peer Lending Account And General Attributes To Lending Success

Funny Quote Maybe P2p Lending Will Change This Peer To Peer Lending Business Loans P2p Lending